Unlocking the Power of Trading View: The Ultimate Guide for Traders and Investors

In the fast-paced world of financial markets, having access to real-time data, advanced chart analysis, and collaborative tools can significantly enhance your trading performance. One platform that has garnered widespread acclaim for its comprehensive features is trading view. Whether you’re a seasoned investor or a novice trader, understanding how to leverage Trading View’s capabilities is crucial for making informed decisions and staying ahead in today’s dynamic markets.

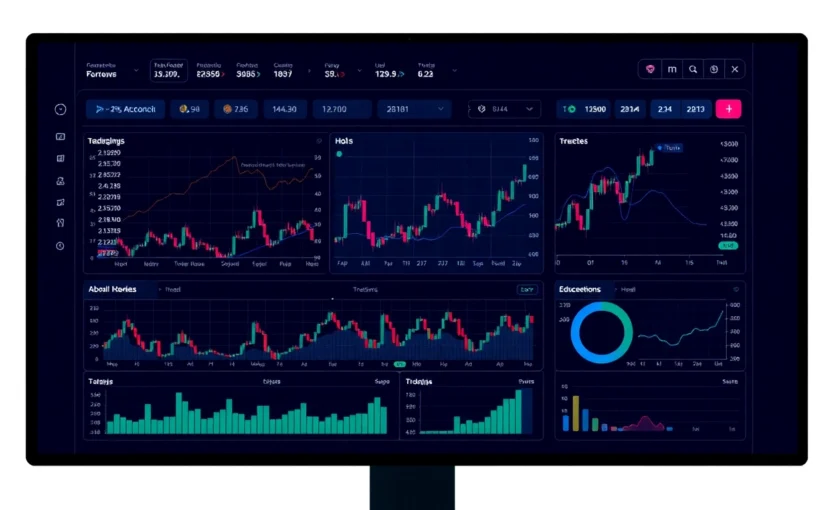

Introduction to Trading View and Its Benefits

Trading View is not just another charting tool; it is a holistic financial analysis platform that combines cutting-edge charting features, social interaction, and automation to serve millions globally. As noted by its user base and industry reviews, it offers a supercharged environment where traders can track all markets, share insights, and execute strategies seamlessly.

The platform’s appeal lies in its versatility—providing real-time data on stocks, cryptocurrencies, forex, commodities, and indices. Its social network component fosters collaboration, enabling traders to discuss ideas, share strategies, and learn from each other. This integration of social features with powerful analytical tools makes Trading View stand out among competitors and a top choice for a comprehensive trading toolkit.

Key Features That Enhance Trading Performance

Advanced Charting and Visualization

At the core of Trading View are its sophisticated charting tools, offering multiple timeframes, customizable layouts, and hundreds of chart types including candlestick, bar, line, and area charts. Traders can add trendlines, Fibonacci retracements, and other visual aids to identify potential support and resistance levels accurately.

Extensive Indicator Library

Users can access over 100 built-in indicators such as Moving Averages, RSI, MACD, Bollinger Bands, and Ichimoku Clouds. Additionally, the platform supports custom scripts through Pine Script, empowering traders to develop and implement personalized signals tailored to their strategies.

Real-Time Data and Alerts

One of Trading View’s most valued features is its ability to provide real-time market data with customizable alerts. Traders can set price alerts, indicator alerts, and news notifications, ensuring they never miss critical trading opportunities.

Understanding the Trading View User Interface

The interface of Trading View is intuitively designed to balance simplicity with functionality. It features a primary chart window, side panels for watchlists, indicators, and data sources, as well as customization options that allow users to tailor the workspace to their preferences.

Navigation is streamlined through a menu bar that offers quick access to chart templates, drawing tools, social features, and trading integrations. Despite its depth, beginners can find shortcuts and guided tutorials that facilitate onboarding and daily use.

Setting Up Your Trading View Account Efficiently

Creating a Watchlist and Custom Layouts

To maximize efficiency, start by building a personalized watchlist comprising your preferred assets—be it cryptocurrencies, stocks, or forex pairs. Organize these assets into groups for quick access. Custom layouts allow traders to save multiple workspace configurations tailored to different trading strategies or market conditions.

Integrating Multiple Data Sources and Indicators

Trading View allows seamless integration of various data sources, including broker accounts for direct trading, and external indicators. Using the platform’s Indicators & Strategies panel, you can combine multiple technical tools to refine your analysis.

Configuring Alerts for Optimal Timing

Setting precise alerts is vital for capitalizing on trading opportunities. Establish alerts based on price levels, indicator crossovers, or pattern formations. Alerts can be sent via email, SMS, or pop-up notifications, ensuring timely responses even when you’re away from your desk.

Technical Analysis Using Trading View

Applying Chart Patterns and Trendlines

Recognizing chart patterns like Head and Shoulders, Double Tops/Bottoms, and Triangles can provide early signals of trend reversals or continuations. Trendlines help define the slope of price movements, aiding in the identification of current market direction.

Utilizing Indicators and Signal Generators

Combine indicators such as RSI for momentum, Bollinger Bands for volatility, or MACD for trend confirmation to generate trade signals. Custom scripts can also automate this analysis, delivering alerts when certain conditions are met.

Advanced Charting Techniques for Better Trends Prediction

Utilize techniques like Elliott Wave analysis, Gann fans, or Fibonacci retracements to forecast market movements more accurately. Backtesting these methods on historical data helps validate their effectiveness within your trading framework.

Developing and Sharing Trading Strategies

Building and Backtesting Custom Scripts

Pine Script, Trading View’s scripting language, empowers traders to create custom indicators and strategies. Backtesting these strategies on historical data allows you to assess their robustness before deploying them live.

Collaborating with the Community and Sharing Ideas

The social aspect of Trading View encourages collaboration through idea sharing, commenting, and publishing public scripts. Traders can learn from community insights, gain feedback, and refine their strategies accordingly.

Case Studies of Successful Trading Strategies

Many traders leverage Trading View’s tools to develop strategies that have resulted in significant gains. For example, combining moving average crossovers with volume analysis, while continuously refining based on backtested results, has yielded consistent profitability for some traders.

Maximizing Efficiency with Trading View Tools

Using Mobile Apps for On-the-Go Trading

Trading View offers robust mobile applications compatible with iOS and Android. These apps enable traders to monitor markets, receive alerts, and execute trades anytime, anywhere, ensuring that no opportunity is missed during busy schedules or market volatility.

Automating Trades with Trading View Alerts

By configuring intelligent alerts, traders can automate parts of their trading process. For instance, alerts triggered by specific indicator conditions can signal manual trades or trigger API-connected bots to execute strategies automatically.

Analyzing Market Sentiment Through Social Features

Insights from community discussions and shared ideas can serve as a form of sentiment analysis. Monitoring trending themes or popular trading setups can provide a complementary perspective to technical analysis, enhancing overall decision-making.