Understanding the Fundamentals of Buying Shares in the UK

Investing in shares is one of the most effective ways to build wealth and achieve financial goals over time. Whether you’re looking to supplement your income or prepare for retirement, understanding how to buy shares in the UK is essential. The process involves choosing suitable platforms, understanding the market mechanics, and managing associated costs and taxes. For newcomers, this might seem complex, but with a structured approach, you can confidently navigate the UK stock market and make informed investment decisions. To get started, explore the comprehensive guide on Buying Shares UK and familiarize yourself with the key steps involved.

What Are Shares and How Do They Work?

Shares represent ownership stakes in a company. When you buy shares, you become a part-owner, entitled to a proportion of the company’s profits, typically via dividends, and the potential for capital growth if the company’s value increases. Shares are traded on stock exchanges such as the London Stock Exchange (LSE), where prices fluctuate based on supply, demand, and company performance. The value of your shares can go up or down, making stock investing both opportunity-rich and inherently risky.

Understanding the distinction between different types of shares—ordinary shares, preference shares, and others—is vital. Ordinary shares usually confer voting rights and dividends, whereas preference shares may have fixed dividends but limited or no voting rights. Recognizing these differences helps investors align their strategies accordingly.

Legitimate Platforms for UK Share Investment

Investing in shares should always be conducted through reputable platforms that are regulated by UK financial authorities like the FCA. Leading online brokerages such as Barclays Smart Investor, Hargreaves Lansdown, HSBC UK, and newer fintech apps like Trading212 or Invest Engine offer user-friendly interfaces, transparency, and safety features. These platforms provide access to the UK stock market, allow you to place buy or sell orders, and often come with educational resources to guide beginners.

Choosing the right platform depends on factors like trading fees, available investment options, account types (e.g., ISAs, SIPPs), and customer support services. Conduct thorough research and consider platforms with good user reviews, robust security measures, and competitive pricing to ensure your investments are secure and cost-effective.

Key Definitions: Shares, Stocks, and Equities

While often used interchangeably, these terms have subtle differences. “Shares” specifically refer to units of ownership in a single company. “Stocks” is a broader term mainly used in American English, while “equities” encompass all shares representing ownership in companies. Grasping these distinctions is important for understanding investment literature and communicating effectively with financial professionals.

For example, owning shares in Apple (AAPL) or Vodafone provides different exposure to the respective markets, and understanding whether you’re investing in a company’s shares or in stock markets as a whole influences your strategy and risk management.

A Step-by-Step Guide to Buying Shares in the UK

Opening a Trusted Trading Account

The first step is choosing a reliable brokerage or trading platform. This involves completing an application which verifies your identity and financial status, ensuring compliance with anti-money laundering laws and financial regulations. Many platforms now offer digital onboarding, allowing you to open an account within minutes. For example, platforms like IWeb or HSBC’s InvestDirect facilitate straightforward account setup tailored for both beginners and seasoned investors.

Considerations when selecting a platform include transaction fees, user interface, educational tools, and available account types like ISAs or general investment accounts. Opening an account is a critical step, as it forms the foundation for executing trades seamlessly and securely.

Researching Suitable Shares and Sectors

Before placing any orders, conduct comprehensive research to identify promising shares and sectors. Utilize financial news outlets, stock screeners, and company reports to analyze performance metrics, growth potential, and risks. Diversification across different sectors—such as technology, healthcare, and finance—can mitigate risks associated with market volatility.

It is advisable to start with blue-chip stocks listed on the FTSE 100 or FTSE 250, as they tend to offer stability and dividend payouts. Additionally, consider investing in ETFs or index funds to gain exposure to entire sectors or the broader market with reduced risk.

Executing Your First Share Purchase

Once you’ve identified the shares you wish to buy, log into your trading account and place a buy order. You’ll need to specify the number of shares, order type (market or limit), and confirm the transaction. Market orders execute immediately at the current market price, ideal for quick transactions, while limit orders allow you to set a maximum price you’re willing to pay.

Throughout the process, review transaction details carefully. Upon confirmation, your shares will be credited to your account, and you’ll receive a trade confirmation. Remember to keep records of all transactions for tax and tracking purposes.

Financial Considerations When Buying Shares in the UK

Understanding Stamp Duty and Transaction Fees

A key cost when buying UK shares is the stamp duty reserve tax (SDRT), which is currently set at 0.5% of the purchase price. This tax applies to most transactions involving UK-listed shares and is payable directly to HM Revenue & Customs (HMRC) through your broker.

Aside from stamp duty, brokers may charge transaction fees or commissions. Some platforms offer zero-commission trading but might compensate through other fees or tighter spreads. It’s essential to compare these costs, especially if you plan to make frequent trades, to ensure cost-effectiveness.

Tax Implications and Reporting

Investing in shares has tax implications, notably Capital Gains Tax (CGT) and income tax on dividends. The UK offers an annual CGT allowance (£12,300 in the 2024/25 tax year), meaning gains below this threshold are tax-free. Dividends are also subject to taxation, with allowances and rates that depend on your income tax band.

Using tax-efficient wrappers like Stocks and Shares ISAs can shield your investments from taxes, allowing your gains and dividends to grow tax-free. Always keep detailed records of transactions and dividends received for accurate tax reporting, and consult a tax advisor to optimize your investment strategy.

Cost-Effective Strategies for Beginners

Beginners should focus on minimizing costs by choosing platforms with low fees and leveraging tax-advantaged accounts. Investing in diversified funds initially reduces the risk associated with individual stocks. Regularly contributing small amounts rather than large lump sums can also help smooth market volatility and build disciplined investing habits.

Moreover, sticking to a long-term perspective and avoiding emotional reactions to short-term market fluctuation enhances the potential for sustained growth and wealth accumulation.

Best Practices for Safe and Successful Share Investing

Diversification and Risk Management

Distributing your investments across various sectors, industries, and asset classes reduces exposure to specific risks. Even within stocks, diversification can be achieved through ETFs or managed funds, providing exposure without the need to pick individual winners.

Utilizing stop-loss orders and setting realistic profit targets further helps in managing risks, preventing significant losses during downturns.

Monitoring Market Trends and Share Performance

Keeping abreast of macroeconomic indicators, geopolitical developments, and company-specific news informs better decision-making. Monitor your investments periodically using tools and alerts provided by your platform. Regular reviews enable rebalancing your portfolio when necessary, aligning it with evolving market conditions and personal financial goals.

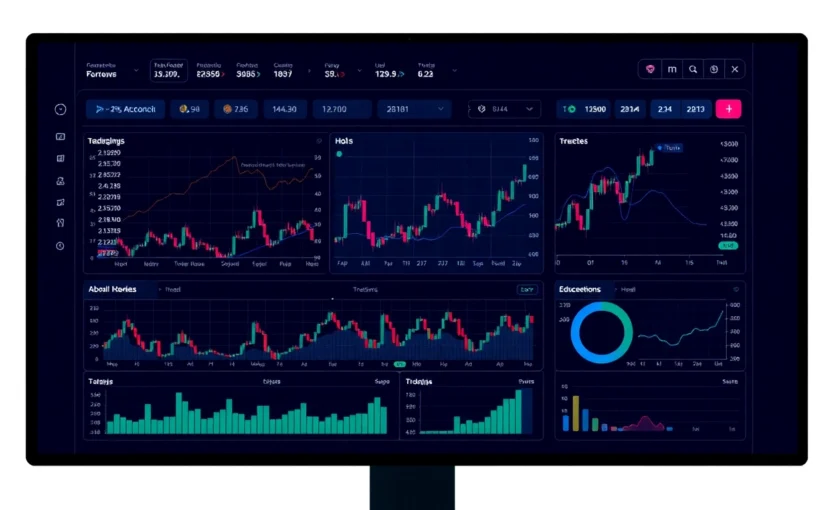

Leveraging Investment Tools and Resources

Utilize analytics software, financial news, and research reports to identify trends and opportunities. Many platforms offer educational content, webinars, and simulation tools for practicing trades without risking real money. Staying informed and educated empowers you to make confident, strategic decisions.

Advanced Tips and Common Challenges in Buying Shares UK

Getting Started with Direct Share Purchase

Some investors prefer to buy shares directly from companies via Direct Share Purchase Plans (DSPPs). While less common in the UK, this approach can minimize broker fees and provide a straightforward way to accumulate shares gradually. Always verify whether companies offer such plans and understand their terms and conditions beforehand.

Overcoming Common Beginner Mistakes

New investors often fall into traps like overtrading, chasing high returns, or neglecting diversification. Developing a disciplined investment plan, setting clear goals, and understanding your risk tolerance are key to avoiding these pitfalls. Additionally, avoid making decisions based solely on market hype or short-term volatility.

Long-Term Growth Strategies and Portfolio Optimization

Patience and consistent investing are the cornerstones of long-term wealth accumulation. Regularly reassess your portfolio to ensure it aligns with your evolving goals. Consider periodic rebalancing, reinvesting dividends, and staying committed to your strategy, even during turbulent periods.