Master the Art of Investing with this Comprehensive Online Trading Guide

In today’s rapidly evolving financial landscape, the ability to navigate the world of online trading is more crucial than ever. From stocks and bonds to cryptocurrencies and commodities, a well-informed investor can seize opportunities across diverse asset classes. Whether you’re a novice taking your first steps or an experienced trader aiming to refine your strategies, understanding the fundamentals, tools, and advanced techniques is essential for success. This guide offers a deep dive into the essential aspects of online trading, equipping you with the knowledge and practical insights needed to master this dynamic domain.

For those seeking a structured pathway into online trading, our comprehensive Online Trading Guide serves as an invaluable resource. Let’s explore the core components of effective online trading, from basic concepts to sophisticated investment tactics.

Understanding the Basics of Online Trading

What Is Online Trading and How Does It Work?

Online trading involves buying and selling financial instruments through internet-based platforms. It democratizes access to global markets, enabling individual investors to operate similarly to institutional players. At its core, online trading works via electronic exchanges, where transactions are executed within milliseconds. Investors utilize trading accounts offered by brokers, who provide platforms that facilitate order placement, real-time market data, and analytical tools.

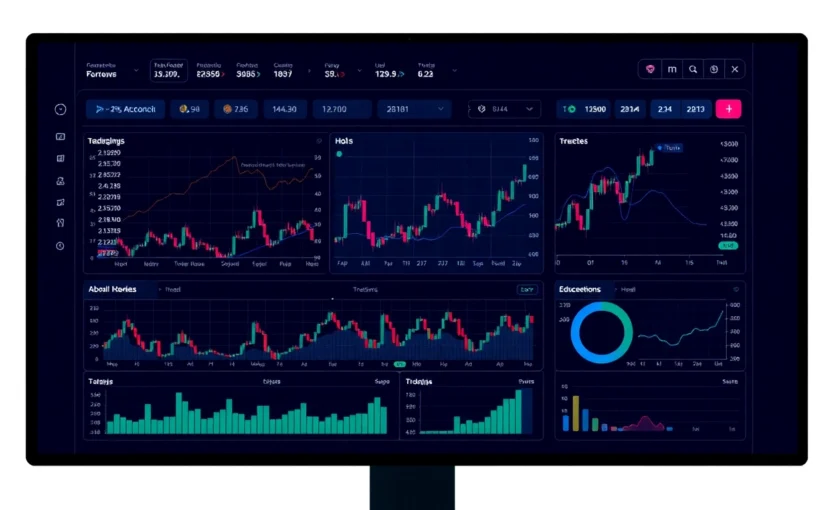

Trading platforms range from user-friendly mobile apps for beginners to advanced desktop systems loaded with technical analysis features. The mechanics involve analyzing market data, placing orders (buy or sell), and executing trades automatically or manually. The key is understanding how these systems interface with market liquidity and price movements, which can be influenced by global economic news, geopolitical events, or market sentiment.

Key Trading Platforms and Tools Explained

Choosing the right platform is pivotal. Leading platforms such as MetaTrader 4/5, Interactive Brokers, and eToro offer a broad array of tools suited for different trading styles. Essential features include live market quotes, charting tools, technical indicators, and automated trading options.

Advanced traders often rely on algorithmic trading systems, customized scripts, and bots to capitalize on small price disparities. Additionally, risk management tools—like stop-loss and take-profit orders—are vital for controlling downside exposure. Many platforms also incorporate educational resources, social trading networks, and news feeds to support decision-making.

Common Mistakes Beginners Make and How to Avoid Them

Starting with high expectations and inadequate knowledge can lead to costly mistakes. Common errors include overtrading, poor risk management, ignoring transaction costs, and emotional trading. To avoid these pitfalls, beginners should adhere to disciplined trading plans, start with demo accounts, and focus on understanding market trends before risking real capital. Continuous education and prudent capital allocation are key to long-term success.

Developing a Winning Trading Strategy

Analyzing Market Trends and Data

Successful trading hinges on accurate analysis. Market trend analysis involves identifying patterns—uptrends, downtrends, or consolidations—through technical charts and fundamental indicators. Moving averages, volume trends, and price action help traders determine optimal entry and exit points. Additionally, fundamental data like economic reports, earnings, interest rates, and geopolitical developments provide context affecting long-term investment outlooks.

Advanced traders utilize tools like candlestick patterns, Bollinger Bands, and Fibonacci retracements to refine their entries. Combining technical and fundamental insights yields a more comprehensive view, enabling better timing and risk management.

Risk Management Techniques for Online Traders

Risk mitigation is essential in volatile financial markets. Effective techniques include setting stop-loss orders at predefined levels to limit potential losses, diversifying across asset classes, and maintaining a risk-reward ratio that favors gains over losses. Position sizing, based on account balance and volatility, ensures traders do not overexpose themselves during adverse moves.

Furthermore, maintaining emotional discipline—avoiding impulsive decisions amid market fluctuations—is crucial. Regularly reviewing performance metrics and adjusting strategies prevents stagnation and ensures alignment with evolving market conditions.

Setting Realistic Goals for Long-Term Success

While trading can be lucrative, it demands patience and realistic expectations. Defining clear objectives—whether income generation, capital appreciation, or hedging—guides strategy development and risk tolerance. Long-term success stems from consistent application of proven principles, continual education, and adaptability to changing markets.

Advanced Techniques and Investment Vehicles

Utilizing Technical and Fundamental Analysis

Blending technical analysis—studying price charts, indicators, and patterns—with fundamental analysis offers a robust approach. For instance, technical signals might indicate an optimal entry, while fundamental insights confirm the asset’s intrinsic value. Techniques such as backtesting strategies over historical data and deploying algorithmic models can enhance precision and reduce emotional bias.

Professionals often use advanced tools like Elliott Wave theory, Gann angles, and macroeconomic models to forecast trends with higher confidence.

Trading Bonds, Forex, and Cryptocurrencies

Beyond stocks, online traders can diversify into bonds, forex (foreign exchange), and cryptocurrencies. Bonds, typically viewed as safer, offer steady income streams. Forex trading involves highly liquid currency pairs, responding swiftly to global events, requiring a solid grasp of macroeconomic fundamentals. Cryptocurrencies, such as Bitcoin and Ethereum, represent a new frontier—marked by high volatility but enormous potential gains.

Each asset class demands specific strategies. For example, forex traders often utilize leverage, which can amplify gains but also losses. Cryptocurrencies require awareness of regulatory environments and security measures against hacking and fraud.

Leveraging Margin and Derivatives Safely

Margin trading allows investors to open larger positions than their capital permits, increasing profit possibilities but also risk. Derivatives like options and futures provide hedging opportunities and strategic flexibility but entail complex risk profiles. Proper education, risk controls, and adherence to regulations are vital when employing these instruments. Using simulation and paper trading can help build competence before deploying real capital.

Tools and Resources for Successful Trading

Best Education Resources to Improve Skills

Continuous learning is fundamental. Reputable online courses, webinars, and certification programs—offered by bodies like CFA Institute or financial technology providers—can deepen knowledge. Subscriptions to financial news outlets, research reports, and analysis platforms also keep traders updated on market shifts and emerging trends.

Practical experience through demo accounts provides invaluable hands-on training, enabling traders to test strategies without financial risk.

Top Analytics and Signal Services

Automated signals and analytical services like TradingView, MarketWatch, and MetaStock assist traders in identifying potential trades based on algorithmic filters and market sentiment analysis. These tools can enhance decision-making speed and accuracy. However, critical evaluation to avoid over-reliance is essential to prevent misguided trades driven purely by automated alerts.

Regulatory Considerations and Security Tips

Maintaining compliance with regional trading laws and regulations is mandatory. Choosing reputable brokers licensed by regulatory authorities ensures compliance and security. Implementing robust security measures—such as two-factor authentication, encrypted communications, and secure password management—protects capital and personal data from cyber threats.

Measuring Performance and Continual Improvement

Tracking and Analyzing Your Trades

Keeping detailed trading journals enables identification of strengths and weaknesses. Tracking metrics such as win/loss ratios, average profit per trade, and drawdowns provides insight into strategy effectiveness. Regular review fosters disciplined execution and facilitates data-driven adjustments.

Adjusting Strategies Based on Market Feedback

Markets are inherently dynamic. Flexibility in refining trading strategies—especially in response to economic changes, geopolitical developments, or technological innovations—is critical. Employing adaptive techniques like position-sizing adjustments and evolving technical indicator parameters sustains profitability.

Building Discipline and Emotional Resilience

Trading psychology significantly influences outcomes. Maintaining emotional resilience involves setting realistic expectations, practicing patience, and adhering strictly to predefined plans. Techniques such as mindfulness and stress management can improve decision-making under pressure, reducing impulsive reactions and fostering consistency.